DETR: Corrected 1099-Gs will come, but not fast

Donovan Thiessen never filed for unemployment last year, but got a letter from DETR saying he did. He was a victim of fraud: a scammer pretended to be him and may have gotten unemployment money in his name. "Aside from the income tax headache that's probably going to happen, now I have an identity theft issue perhaps," he said. Thiessen notified DETR, but because it was so overwhelmed earlier this year, it may or may not have caught the problem.

FYI: Your federal 'check' might arrive as a debit card

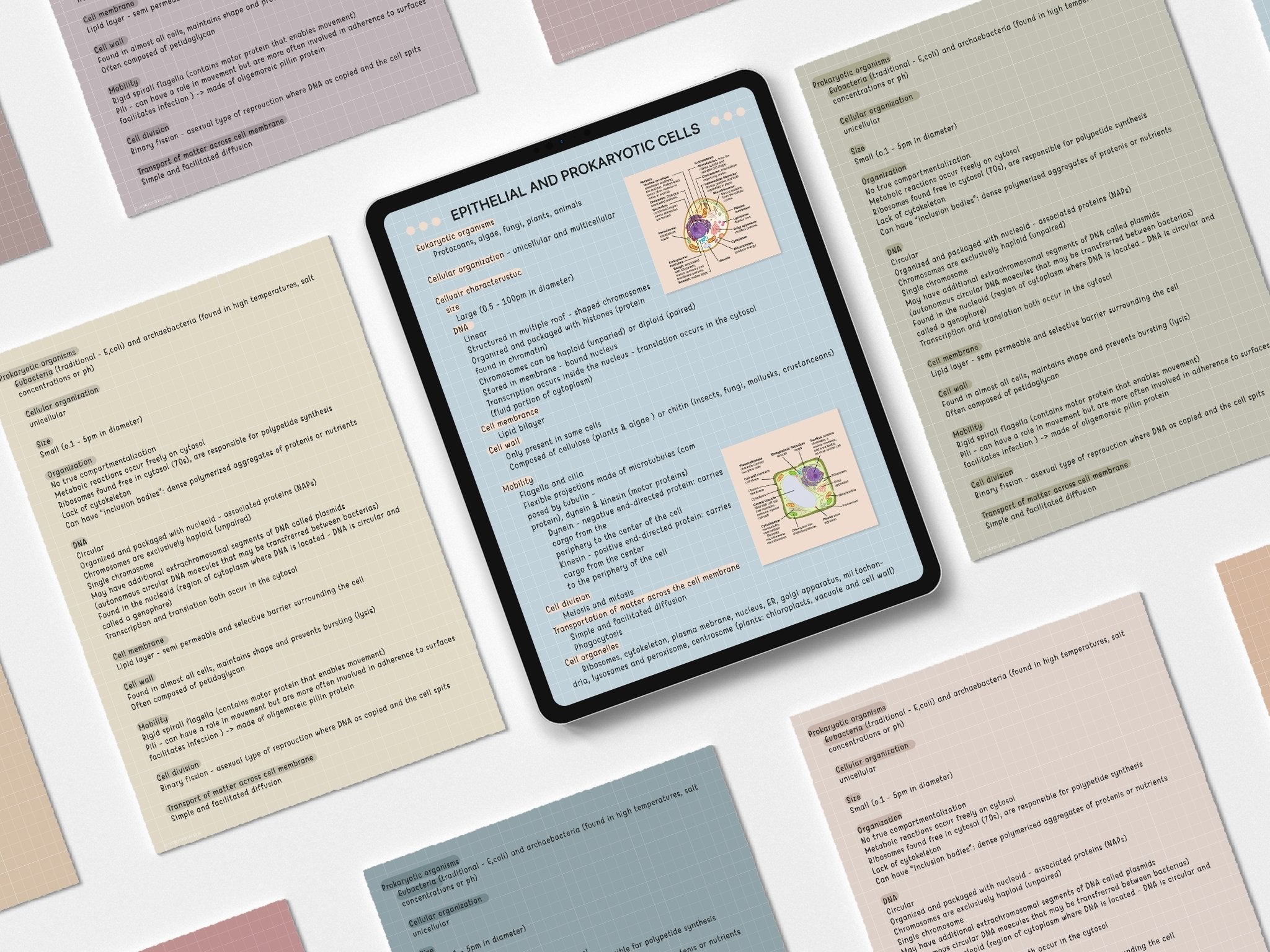

PG_0122 by ensembleiq - Issuu

Tax refunds: Stimulus payments, child credits could complicate filings

What if I received a 1099-G Form and I do not agree with the amounts? The 1099-G includes your weekly benefit amount paid plus all stimulus payments, By Detr Nevada

3.13.222 BMF Entity Unpostable Correction Procedures

DETR: Corrected 1099-Gs will come, but not fast

Submitting Corrections

How to file 1099, 1098, W-2, 1042-S corrections – eFileMyForms

Can Fidelity issue a Corrected 1099-R due to the incorrect 1099-R they sent to the IRS? Our AGI will go up & SS down. What to do? Fidelity does not answer their

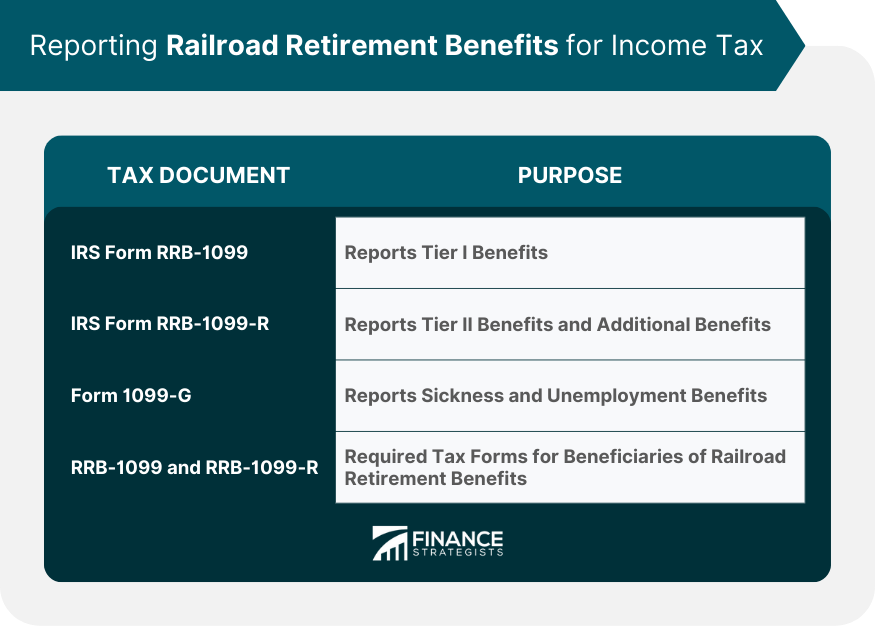

Is Railroad Retirement Income Taxable?

GeneralAire 1099-20 Humidifier Water Filter for 1099 Humidifier Series : Office Products

Wrong Tax Forms Issued - Massachusetts Retirees

Unemployment