Can You Donate Art and Collectibles to a Private Foundation? Understanding the Tax Implications

Our mission is to amplify the positive impact of private foundations and philanthropic families by providing specialized tax and accounting services that fit their unique needs.

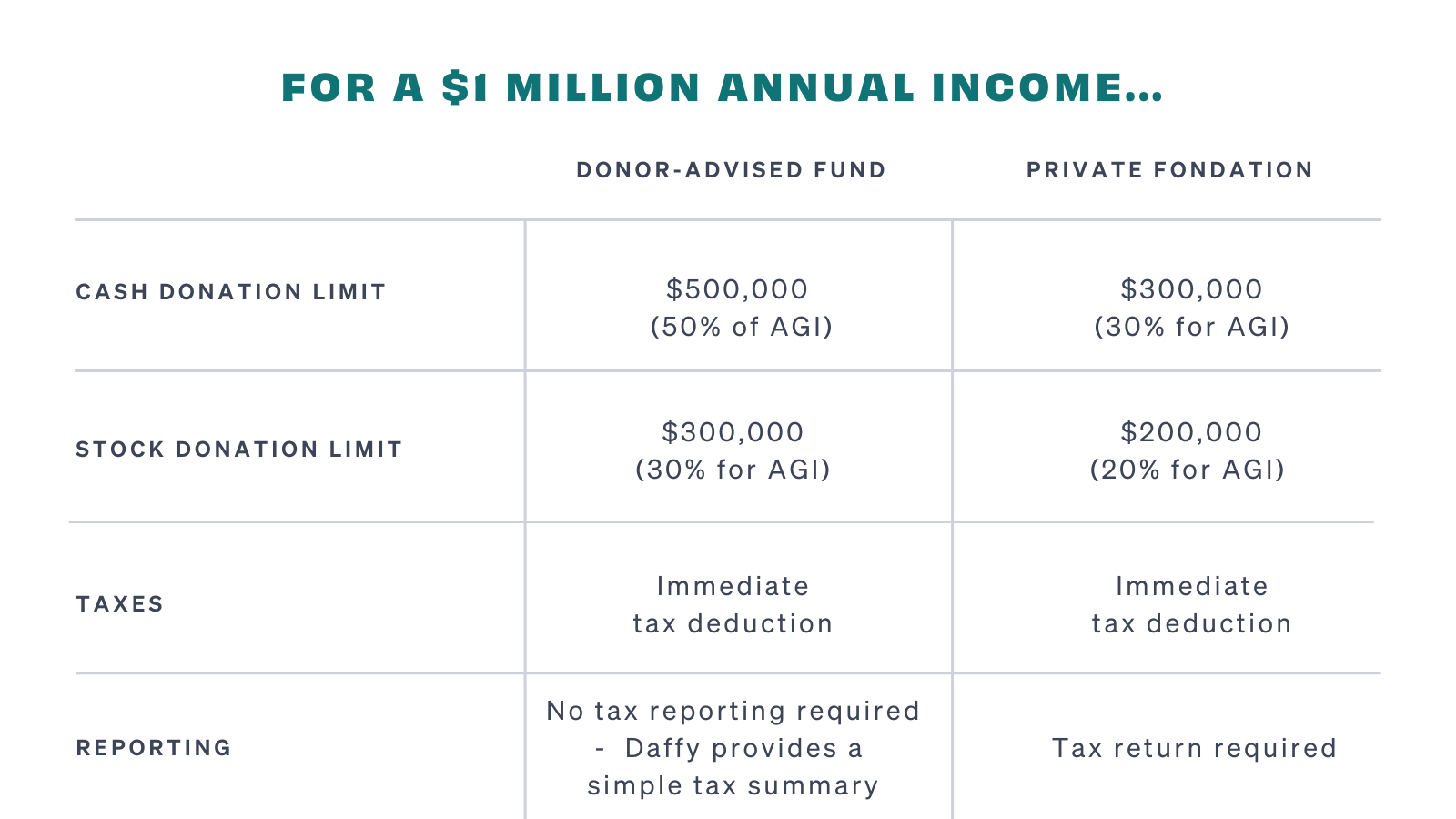

Donor-Advised Funds vs. Private Foundations: What's Best

Tangible personal property: Donating Tangible Assets: Form 8283 Explained - FasterCapital

Three charitable giving trends in 2018 that could shape future policies

Private Client Tax Solutions

Donating Fine Art and Collectibles, Schwab Charitable Donor-Advised Fund

Private Foundations vs. Public Charities: Key Tax Code Distinctions

Private Foundation Bookkeeping

An art collection is a special asset to account for in an estate plan - Merline & Meacham, PA

Charitable Deductions: Your 2024 Guide to the Goodwill Donations Tax Deduction

The Essential Role of Record Keeping in Private Foundations