Tax-Efficient 'Bucket' Retirement Portfolios for Fidelity Investors

Featuring solid muni funds and index equity offerings, these portfolios are appropriate for investors’ taxable accounts.

Is The Bucket Strategy A Cheap Gimmick? - The Retirement Manifesto

My Asset Allocation & Asset Location - by Andre Nader

Fidelity Zero Fee Funds: Are They Really Free? - The Frugal Expat

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

3 Tax-Efficient Bucket Portfolios for Minimalist Retirees

S.M.A.R.T. Retirement Bucketing System™ - IQ Wealth Management

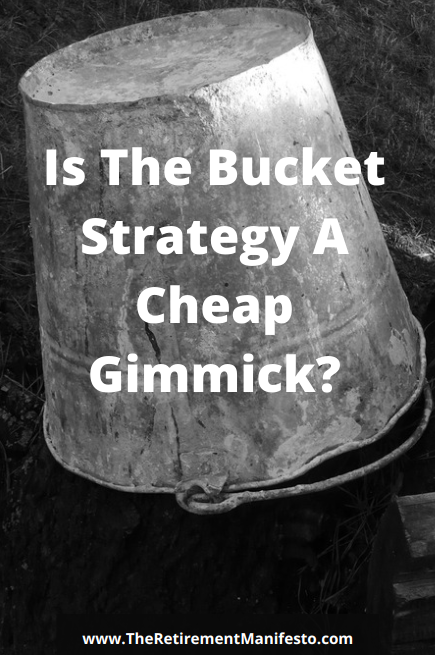

PEMDAS for Investing: A Tax-Efficient Order for Account Funding

My Asset Allocation & Asset Location - by Andre Nader

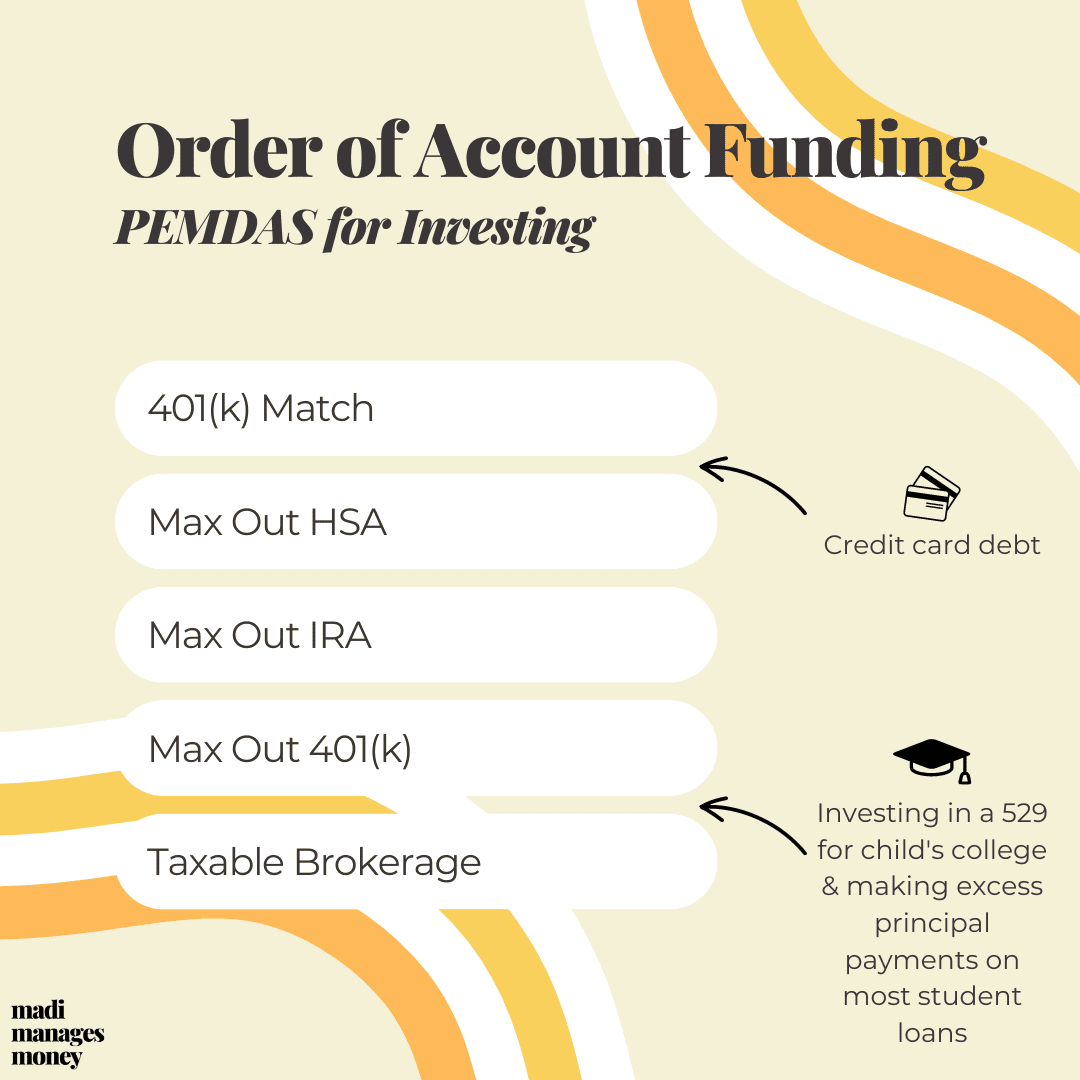

Retirement bucket approach: Cash flow management

I'm Chris Lin, the portfolio manager for the Fidelity OTC Portfolio (FOCPX). I'm here to answer any questions you have related to investment philosophy, market conditions, technology, large-cap growth stocks, or whatever's

Do Fidelity's lower expense ratios result in higher return?

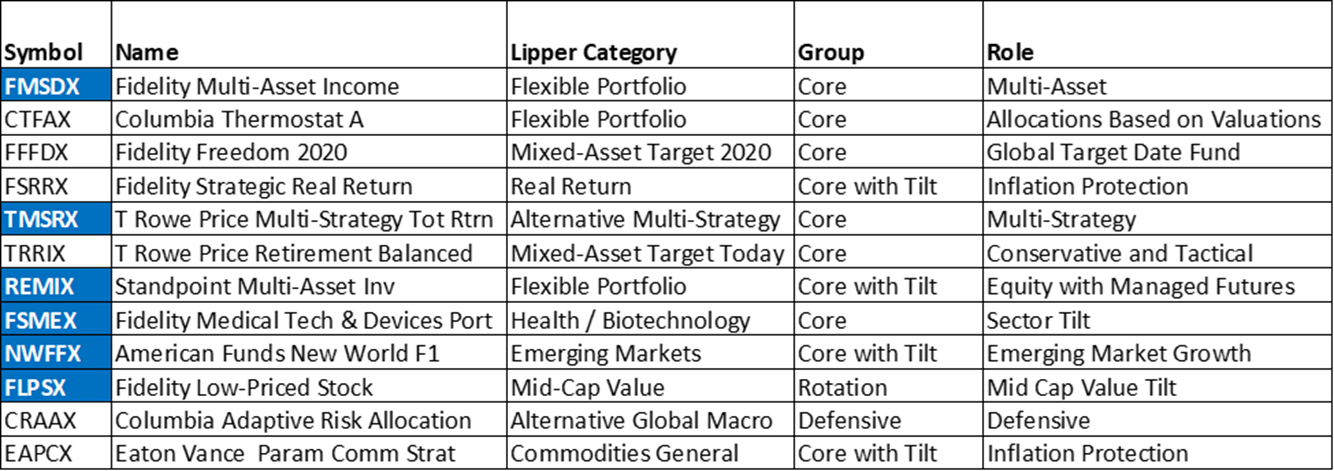

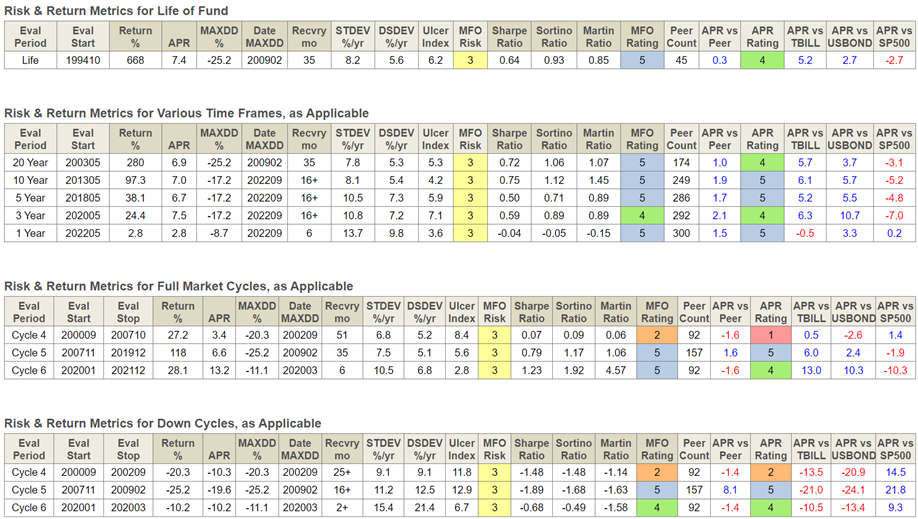

Building a Multi-Strategy Portfolio – Fidelity Traditional IRA

Fidelity Fund Portfolios

Helping a Friend Get Started with Financial Planning

Fidelity® Q2 2022 Retirement Analysis: Even With Market & Economic Uncertainty, Retirement Savers Look Long Term and Continue to Save