Step-By-Step: How To Claim Motor Vehicle Expenses From The CRA

See the methods and a step-by-step explanation of the five steps to claiming motor vehicle expenses from the CRA as a self-employed individual or an employee.

How To Claim CRA-approved Mileage Deductions in Canada

:max_bytes(150000):strip_icc()/conveyor-belt-in-factory-457978597-6dc0d80662994652b10c3e2d0376aaba.jpg)

Capital Cost Allowance (CCA): Definition and How Deduction Works

How to Expense Mileage, Entertainment & Meals

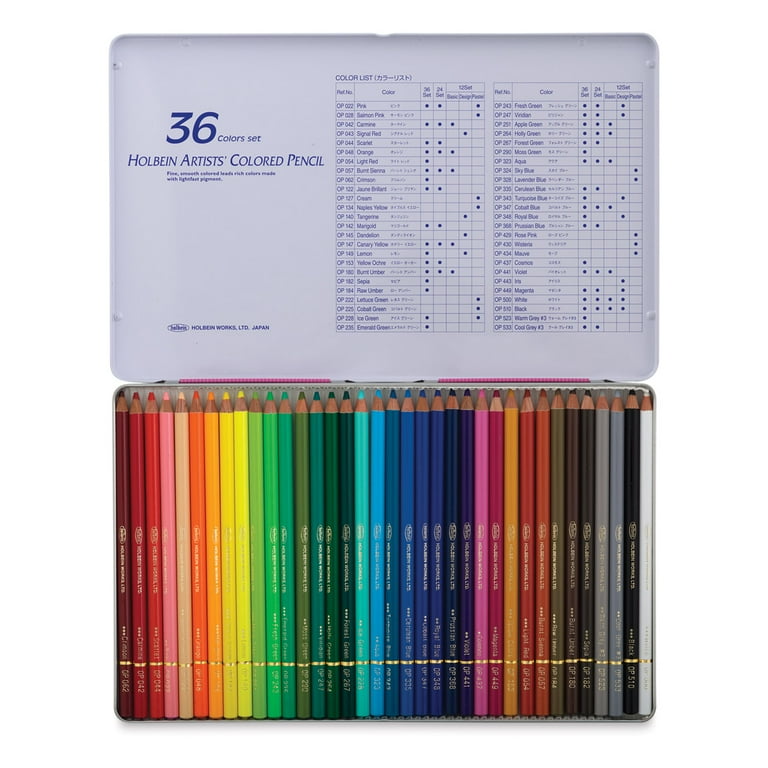

Mileage Log Template 2024, Free Excel and PDF Log Book - Driversnote

Tax Preparation Tip: Handling Work-Related Vehicle Expenses - FBC

Motor Vehicle Expenses as per CRA - You may want to know before buying a new vehicle to be used in your business. - RKB Accounting & Tax Services

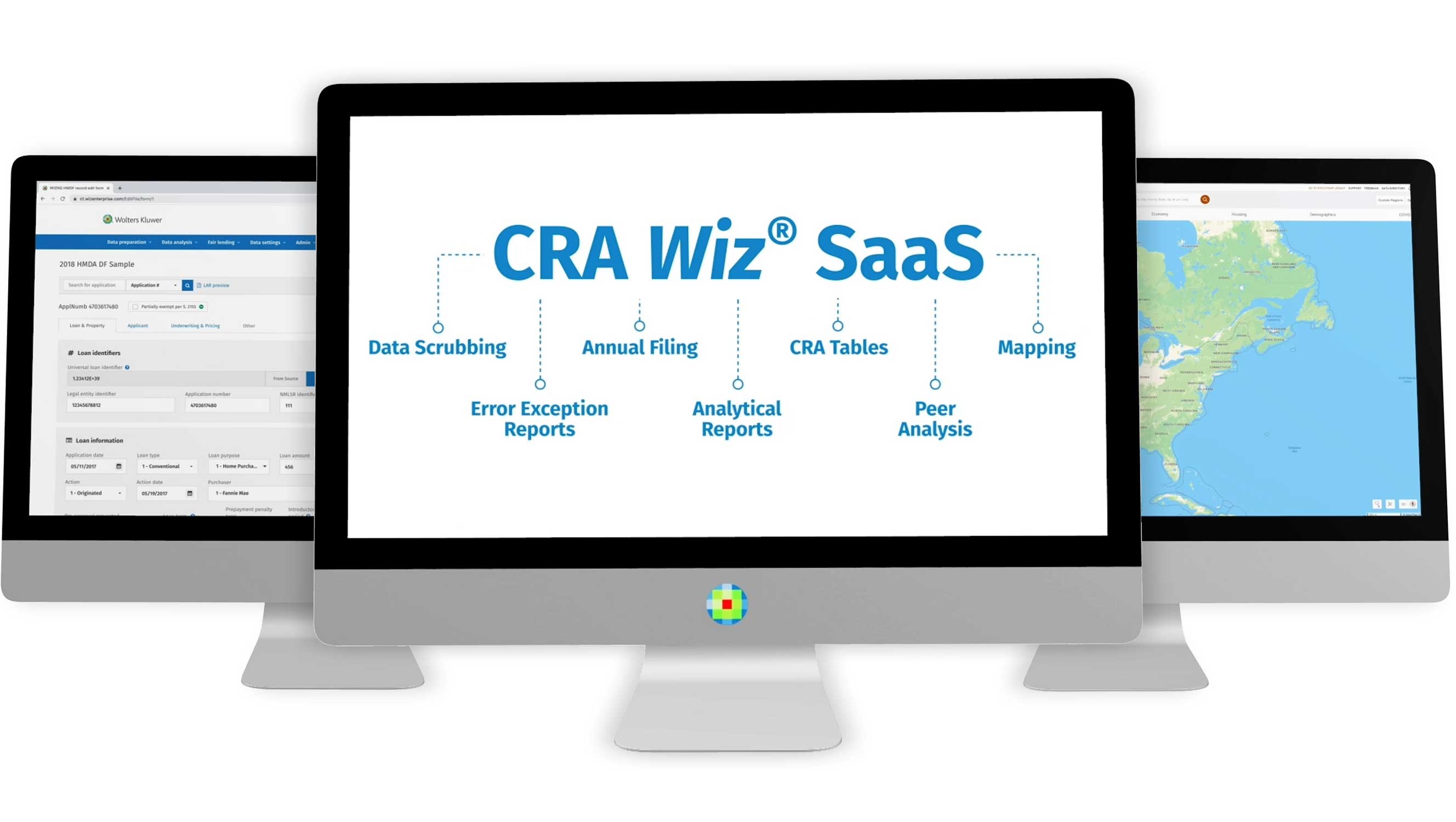

Expense Claim Monthly Flow – Questetra Support

Always keep your receipts — the CRA tells its auditors not to believe you without them

How to keep audit-proof mileage logs that lower your taxes - FBC

)