MAS: AT1 Losses to be Covered by Resolution Fund

In the midst of a Credit Suisse AT1 bond wipeout, the Monetary Authority of Singapore is exercising its powers to allow investors to claim losses from an industry-funded pool.

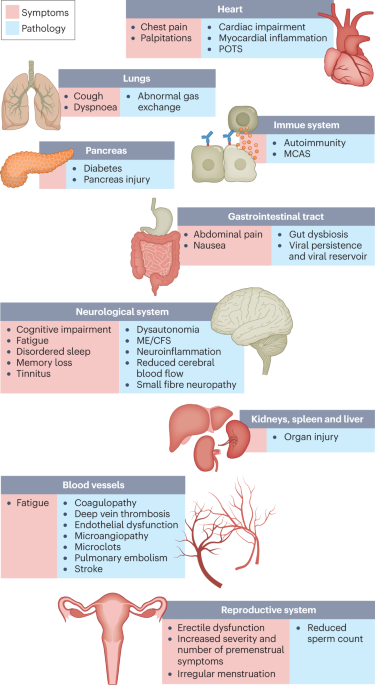

Long COVID: major findings, mechanisms and recommendations

Swiss regulator defends $17bn wipeout of AT1 bonds in Credit Suisse deal

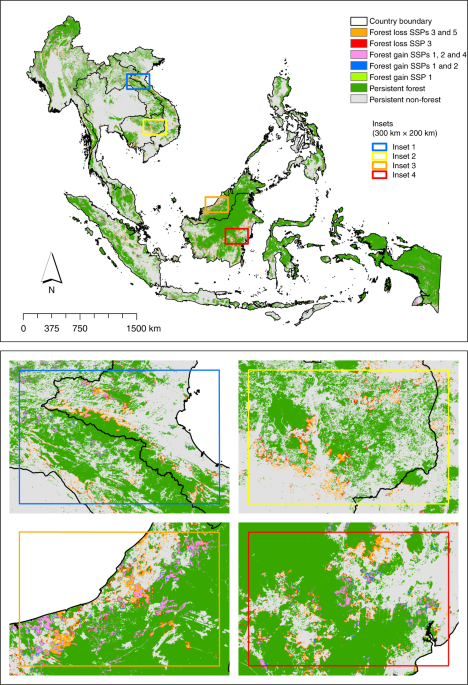

The future of Southeast Asia's forests

The 2021 report of the Lancet Countdown on health and climate change: code red for a healthy future - The Lancet

HKMA: «Shareholders Are the First to Absorb Losses»

TMEM135 links peroxisomes to the regulation of brown fat mitochondrial fission and energy homeostasis

Biomimetic Nanoparticle-Mediated Target Delivery of Hypoxia-Responsive Plasmid of Angiotensin-Converting Enzyme 2 to Reverse Hypoxic Pulmonary Hypertension

Engineered mischarged transfer RNAs for correcting pathogenic missense mutations: Molecular Therapy

Neutral Loss Is a Very Common Occurrence in Phosphotyrosine-Containing Peptides Labeled with Isobaric Tags

Perindopril Attenuates Lipopolysaccharide-Induced Amyloidogenesis and Memory Impairment by Suppression of Oxidative Stress and RAGE Activation

Improvement of Hard Carbon Electrode Performance by Manipulating SEI Formation at High Charging Rates

Facile Metal Release from Pore-Lining Phases Enables Unique Carbonate Zonation in a Basalt Carbon Mineralization Demonstration

Singapore Regulator to Honor AT1 Losses Claim Heirarchy

What are AT1 bank bonds – and why are Credit Suisse's wiped out?, Banking

The contribution of the AT1 receptor to erythropoiesis - ScienceDirect