An Update on the Volatility Risk Premium (VRP) - Gateway Investment Advisers

Our April Market Perspective focused on how the Volatility Risk Premium (VRP) has changed over time and noted that its first quarter of 2020 inversion reached record-setting levels in February. VRP has been positive since mid-March, and averaged 14.23 from March 17 through April 28, i.e. the 21-day1 realized volatility period ending May 27. The VRP average since […]

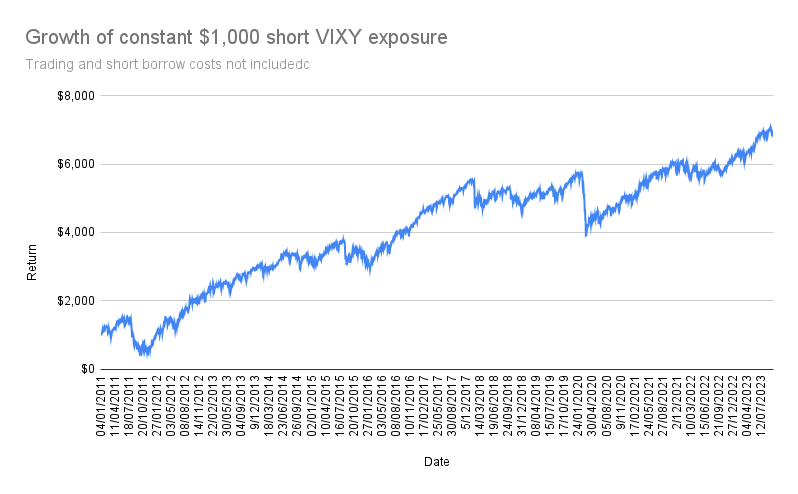

Options Are Persistently Overpriced: Here's How To Profit From The Volatility Risk Premium

The pricing of volatility risk in the US equity market - ScienceDirect

options - How to quantify the Variance Risk Premium (VRP) with probability density functions? - Quantitative Finance Stack Exchange

An Update on the Volatility Risk Premium (VRP) - Gateway Investment Advisers

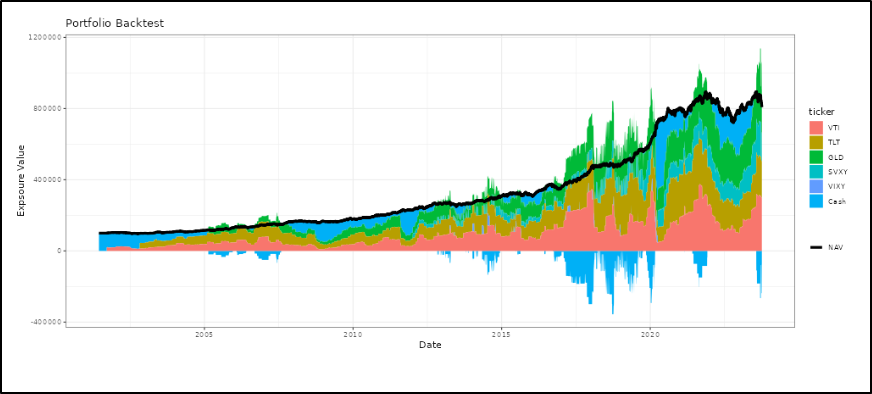

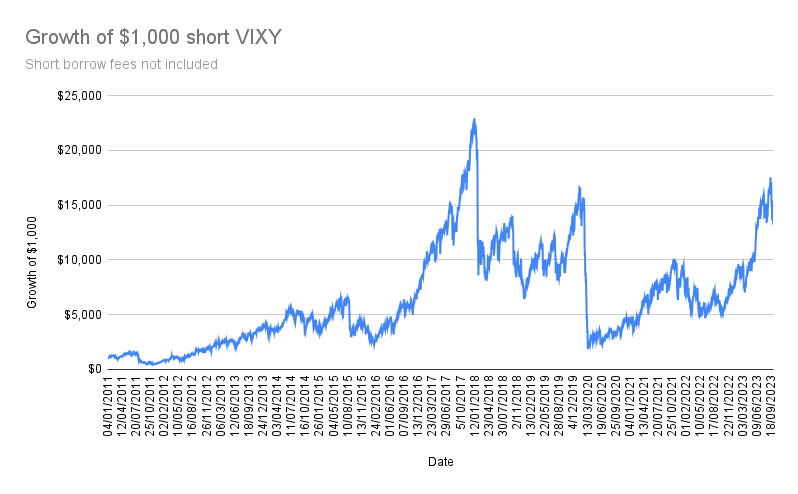

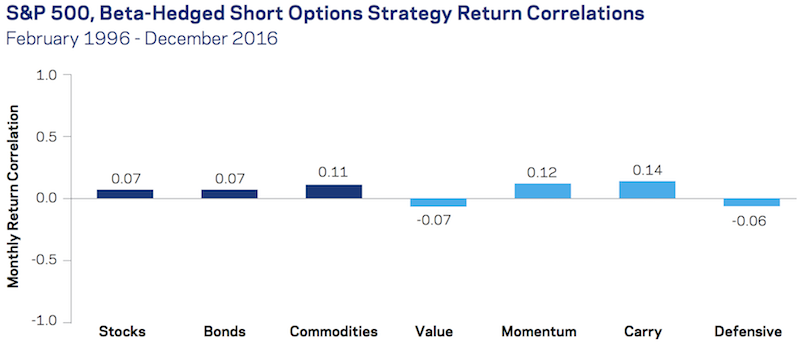

Diving Deep: My Personal Approach to Equity and Volatility Risk Premia - Robot Wealth

Diving Deep: My Personal Approach to Equity and Volatility Risk Premia - Robot Wealth

JRFM, Free Full-Text

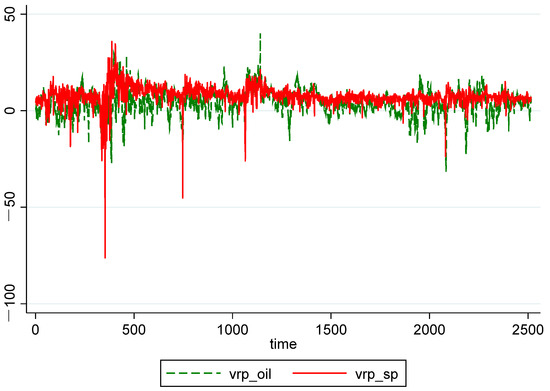

Full article: The volatility risk premium in the oil market

Diving Deep: My Personal Approach to Equity and Volatility Risk Premia - Robot Wealth

JRFM, Free Full-Text

The Option Trader's Guide to the Variance Risk Premium - Predicting Alpha

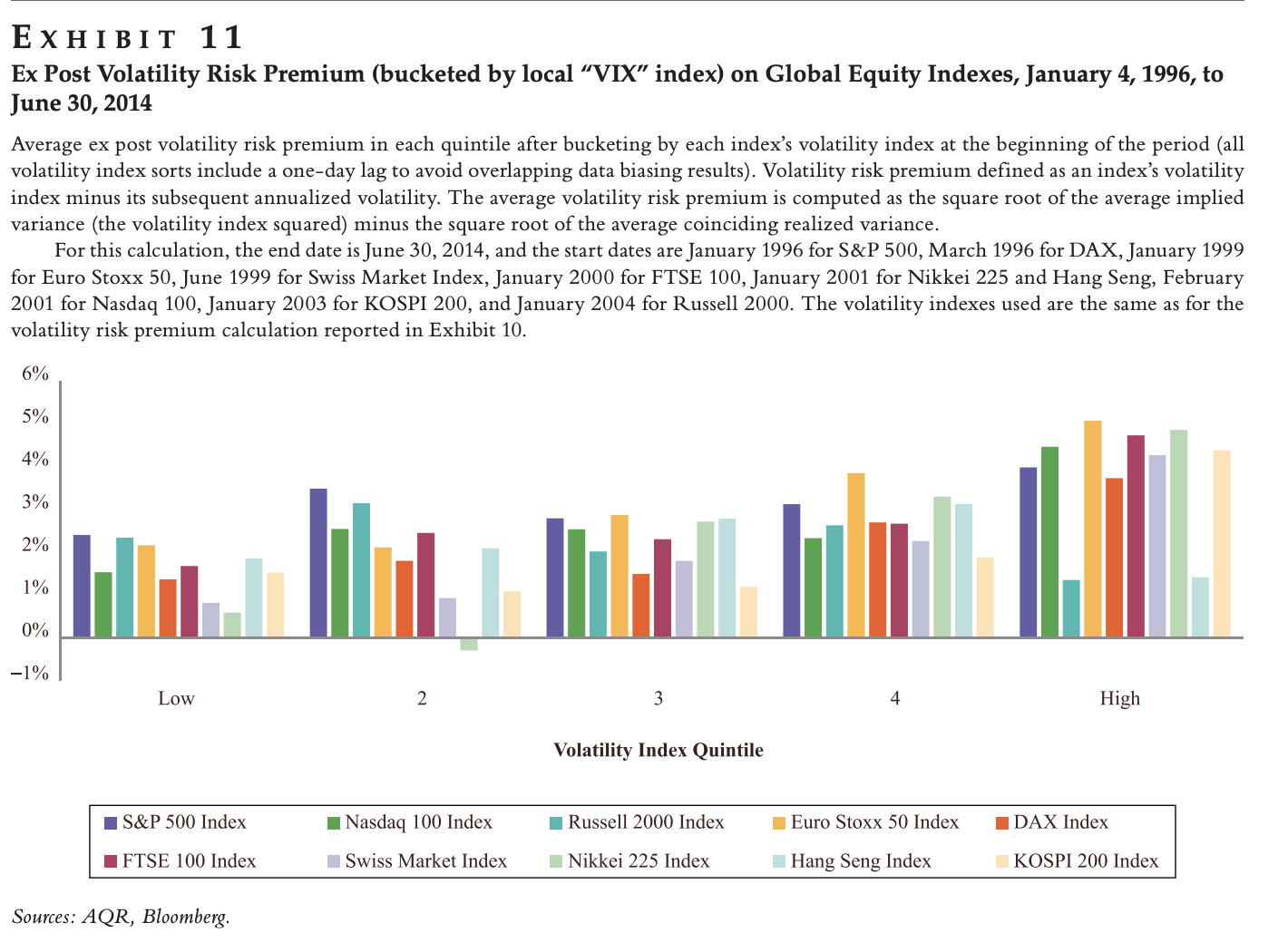

Volatility Risk Premium, Institutional Investors

Volatility Risk Premium (VRP): Portfolio Strategies

Gateway Investment Advisers

Full article: The volatility risk premium in the oil market